Forecasting is an important ingredient for crafting the business strategy, to align the organizational backdrop, as well as for goal setting, budgeting, and campaign planning. Here, we show that strict reliance on quantitative methods may lead to misleading results and wrongly dimensioned organizational structures, as exemplified by a pharmaceutical company with an innovative new compound trying to penetrate new markets.

To come up with more reliable data, we combined market data with qualitative market research. We analyzed the attractiveness of the market by accounting for the healthcare system, practice of healthcare delivery, prescription habits and preferences, together with patient preferences in order to adjust the market data. Looking back today at the projections cast in 2019, our forecast came very close to the actual prescription data, as reported by payers.

Mark Twain’s famous quote “Prediction is difficult- particularly when it involves the future” has been cited extensively to make the point that generating a sound forecast is one of the most challenging undertakings. Sure, unpredictable events, such as the Corona-pandemic may disrupt the most carefully orchestrated forecast. Luckily, however, these black swan events do not appear all that frequently. However, challenges remain and there are plenty of examples of potential breakthrough inventions, which did not live up to their expectation!

Even breakthrough innovations did not live up to their expectations

Yes, prediction is very difficult, but facing real life situations - the true behavior of prescribers and patients - can be even harder. Take Exubera (inhalable insulin) as an example: Everybody thought that this was the best thing since sliced bread!!!! Easy application, no more injections – everybody was sure that this will be the next blockbuster product. But what happened? Pfizer discontinued marketing the product citing that it “failed to gain the acceptance of patients and physicians” and took a $2.8 billion charge.

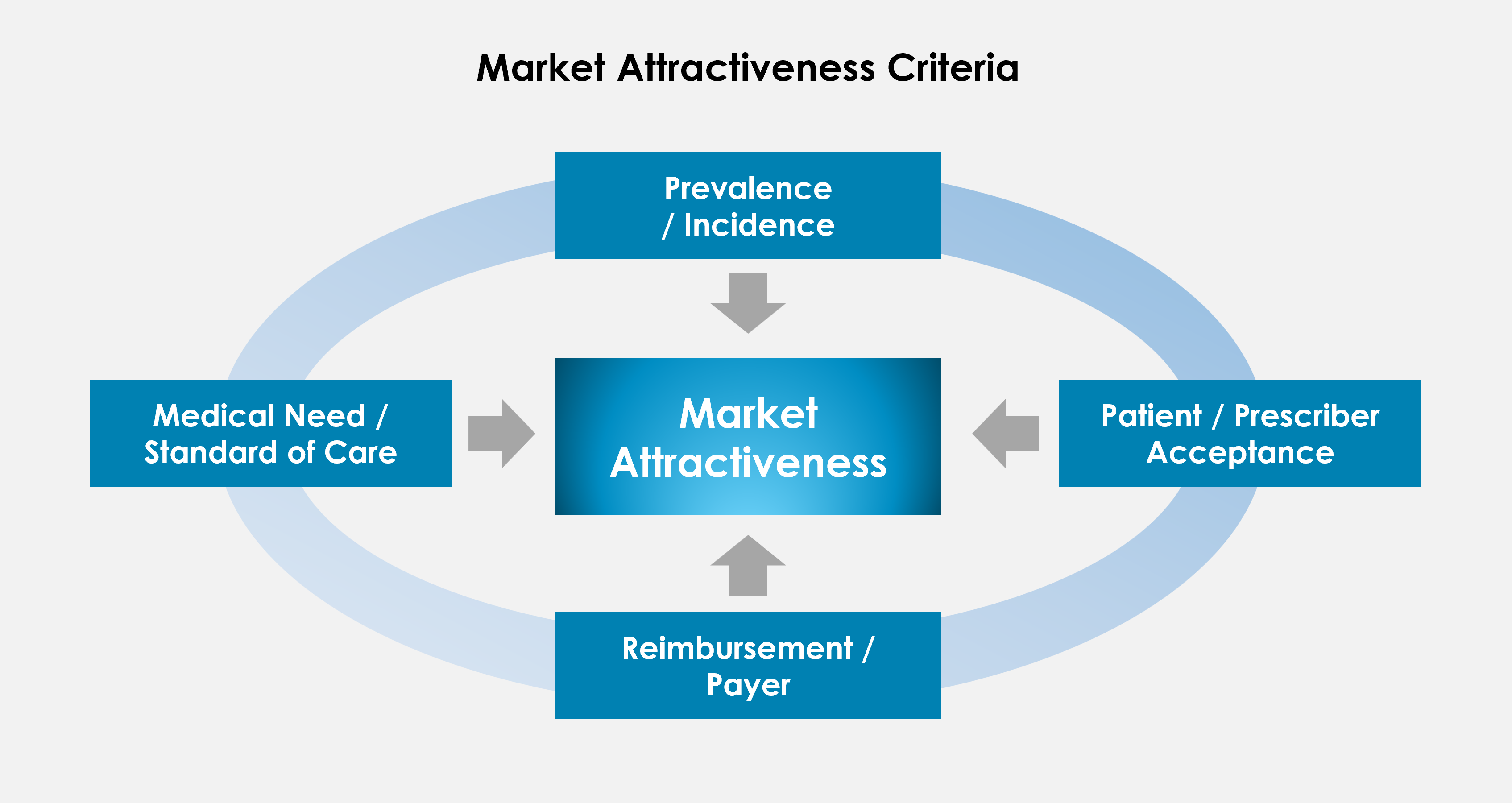

What can we learn from this? Market acceptance is not a given and the attractiveness of a given market (or segment) depends on many factors, mostly qualitative in nature.

Data, of course, but combined with in-depth insights into the market behaviors

To that end, we have developed an integrated approach of combining quantitative market data with more qualitative market insights, for Cogent’s Insights on market research, see https://www.cogent-hc.com/market-research-insights) Being cogent is our signature (and, by the way, the name of the authors´ company, Cogent Healthcare). Taking inspiration from Porter's Five Forces Framework, we developed a model to guide our assessment of the ‘forces’ that drive the attractiveness of a given market. As shown in Fig. 1, some are pretty obvious, such as prevalence of the disease, but others require an in-depth understanding of the market, such as prescription behavior, acceptance by patients, and reimbursement peculiarities, etc.

Fig. 1: Various forces drive the attractiveness of a market

These factors may vary, depending on the segment you are looking at – Rx vs. OTC, but taking a structured approach in the assessment assures that you systematically assess all forces that might influence the market.

Putting it all together – a more realistic forecast

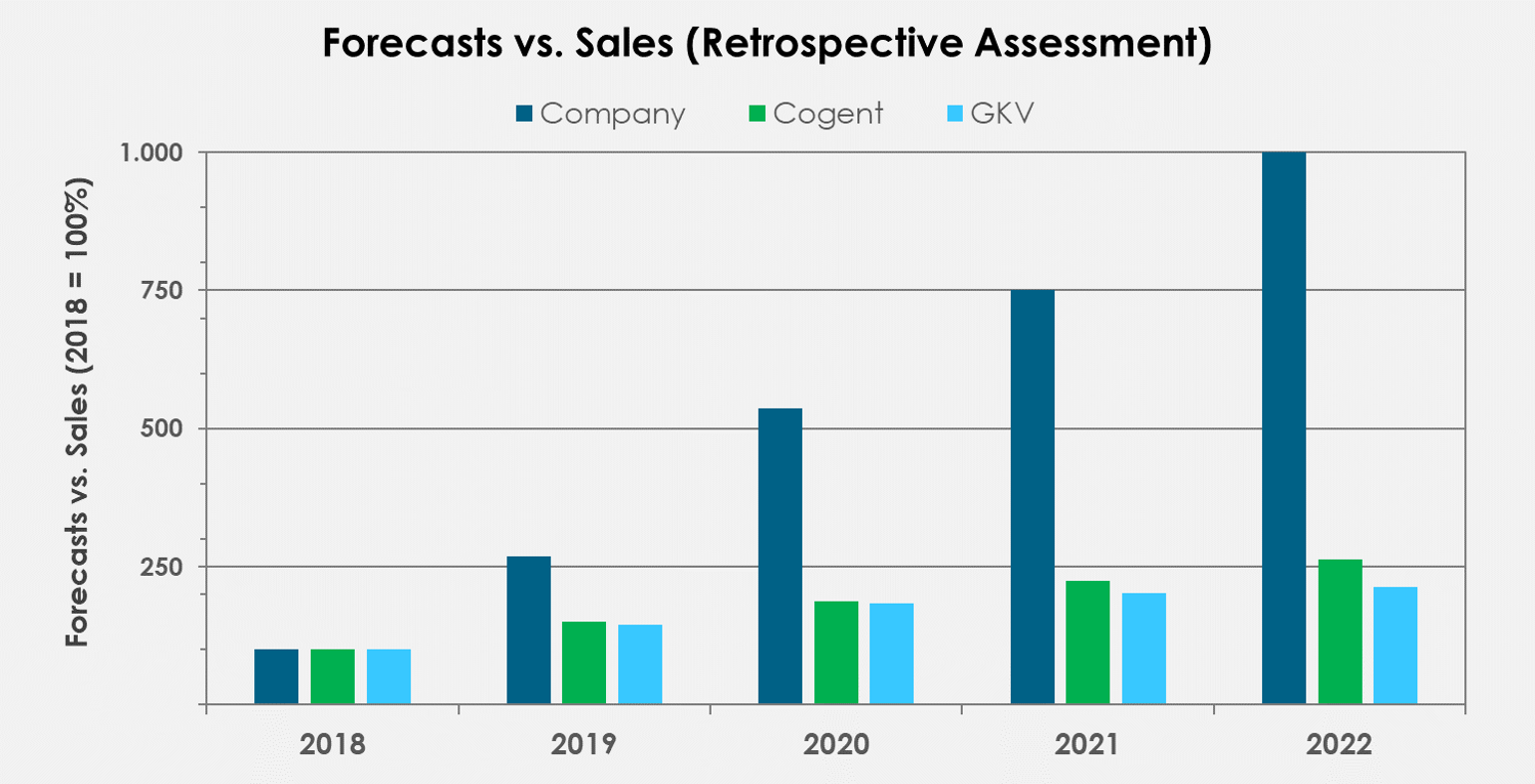

The case study concerns a pharmaceutical company with an innovative new compound trying to enter new markets. Headquarters had advanced forecasts spanning several years and scaled the country organizations to meet those forecasts. About two years following launch, it became clear that there was a massive gap between expectations and reality. That was the point when the company approached Cogent Healthcare to develop a forecast model to more closely reflect the key EU markets. Taking the approach outlined above, we analyzed the market by taking the attractiveness criteria into account, echoed our results with several key stakeholders and developed a model. Needless to say, our forecast differed substantially from that of the company.

Fig. 2: Comparison of the projections cast in 2019 with actual sales data from the German health insurances

As shown in Figure 2, the company projected an almost exponential sales growth (dark blue bars), while our analysis suggested that market barriers will prevent such a massive uptake and the market growth will be steady and more linear. Our forecast (green bars) for 2022 showed sales up 150% over 2018 sales. Quite impressive – less so when compared to the company’s projection of 1000% growth! In the end, our forecast was slightly higher, but much more in line, when compared to the actual sales data reported by the German health insurances (blue bars).

Yes, forecasting is difficult, but …

Looking back, we can say that our approach has reasonably close reflected the true market development. Agreed – aggressive forecasts may be needed to convince investors, etc. However, these hockey-stick sales projections rarely materialize. Setting medium term budgets for the country organization and building the necessary infrastructure is just too important and too costly to simply rely on commercially available market research data. The strong reliance on benchmarks or averages is misleading, since, even within the same therapeutic area, numerous parameters influence the performance of a drug at a given point in time, thus leading to data are not comparable.

We strongly promote adopting a more holistic approach as a foundation for corporate strategy. Our forecasts reflect the intricate dynamics of the individual healthcare markets by refining quantitative data with the results from a qualitative assessment of the country-specific issues that drive market attractiveness. Quite frankly, this may result in a more conservative scenario! However, realizing some upside potential might be more rewarding than chasing elusive targets. Yes, forecasting is difficult - since it always involves the future.

Photo: Owen Beard on Unsplash

Autoren des Beitrags

Prof. Dr. Thomas Teyke

Prof. Dr. Thomas Teyke is a strategy consultant, focused on the global healthcare markets. His consulting focus ranges from R&D management, technology assessments, to market entry, product and portfolio management, strategy development, financing and M&A.

Dr. Stefan Zillikens

Stefan is a commercially oriented international consultant and brings first-hand experience managing all stages of a product lifecycle from his 20+ years Pharma and Biotech industry experience.